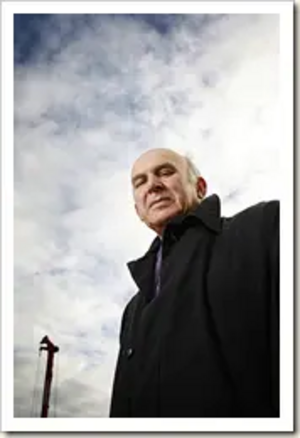

Cable was first to call for breaking up the banks

http://shrewsburylibdems.files.wordpress.com/2010/01/image4.png The Liberal Democrats have been consistently calling for the breaking up of the banks since November 2008.

November 2008 - Vince Cable: "To be sure, it is difficult for banks to raise money but the government should, for a start, insist that they get rid of their investment banking casino operations, which are underwritten by a taxpayers' guarantee, in order to concentrate resources on their mainstream lending." (Read in full here)

December 2008 - Vince Cable: "In the New Year the Government may have to take more direct control of the banks; to restructure them, stripping out their casino operations; and ensuring that banks do their job of lending to sound businesses and households." (Read in full here)

February 2009 - Vince Cable: "I have one final question about what the Prime Minister said in the paper on Sunday about the proposal, which a growing number of people on all sides accept, that in the long term the low-risk high street lending activities of the banks have to be separated from the high-risk casino-type activities with which they have been associated. The Prime Minister seems to have capitulated to pressure to abandon that proposal altogether. I can understand why the banks want to hang on to the operations that generate their bonuses, but why on earth should the Government be giving a long-term guarantee for gambling activities on a global scale? It is incomprehensible and completely without justification." (Read in full here)

March 2009 - Vince Cable: "Split off low risk high street banking from the global, casino-type operations - in other words, run the banks on safe, traditional lines." (Read in full here)

July 2009 - Vince Cable: "The central issue is that these big, global banks, which do ordinary banking in Britain and are global casino operations, have to be split up so that if they do get into serious trouble in the future, the British taxpayer is not underwriting them." (Read in full here)

September 2009 - Vince Cable: "The principles should be clear. Full compulsory disclosure of all pay, bonuses and perks for those earning more than the Prime Minister. The break up of the big banks which are currently too big to fail so that the taxpayer is no longer underwriting casinos. Casinos belong in Las Vegas not in banking. We want straightforward, simple banks which do the basics well; not laboratories for financial rocket scientists." (Read in full here)

The Tories' 'commitment' to breaking up the banks

George Osborne claimed this morning that the Tories have been proposing the breaking up of retail and investment banking 'since last July'.

But if breaking up the banks has been an important long-term priority for the Tories, why was there no mention of it in the press release to accompany Osborne's Financial Regulation White Paper from the same month he claimed to have first proposed it? (Read in full here)

When the paper does go on to address the subject, buried on page 33 of the document, it can hardly be described as a 'proposal':

"We will also expect the Bank to impose much higher capital requirements on high-risk activities, for example, large-scale proprietary trading carried out by banks that also take retail deposits. In practice this could prevent banks that take retail deposits from engaging in many of these high risk activities by making them more expensive.

"Concerns about retail banks using their capital base to fund this sort of high-risk activity have led some to argue that we need a modern version of the separation between retail banks and investment banks imposed by the Glass-Steagall legislation in the US from the 1930s to the 1990s.

"While there are some valid arguments for this approach if implemented at an international level, it would not be feasible or desirable for the UK to impose an absolute separation unilaterally. Instead, we will instruct the Bank of England to instead use capital and liquidity requirements to achieve the same objectives, while continuing to examine the case for a more structural approach in international forums."